Why You Can’t Rely on Consultants Alone for Risk Forecasting

In the complex world of construction project management, risk forecasting is not just a necessity; it’s a strategic advantage. Effective risk forecasting empowers organizations to identify potential threats, assess their likelihood and potential impact, and implement targeted mitigation strategies. While external consultants can provide valuable expertise in this realm, relying solely on them can be a precarious strategy. This blog will delve into the importance of risk forecasting, the limitations of consultants, inherent challenges in forecasting, best practices, and the critical role enhanced platforms like Zepth can play in optimizing risk management.

The Importance of Risk Forecasting

The ability to forecast risks accurately is integral to strategic decision-making, particularly in industries such as construction. Effective risk forecasting serves multiple purposes:

- Strategic Decision-Making: Identifying potential risks allows teams to make informed decisions that mitigate adverse effects on project timelines and budgets.

- Financial Stability and Operational Success: A comprehensive understanding of both internal dynamics and external threats is necessary to maintain financial health and achieve operational excellence.

In a landscape dotted with uncertainties, accurate risk forecasting acts as a compass, guiding companies through potential financial downturns and operational pitfalls.

Limitations of Relying on Consultants

While consultants can enrich risk forecasting processes, several limitations necessitate caution:

- Data and Information Limitations: Consultants may not possess access to the extensive data required for thorough assessments, leading to incomplete or inaccurate conclusions.

- Lack of Continuous Monitoring: Risk forecasting demands ongoing vigilance that consultants, often engaged on a contractual basis, may not provide.

- Limited Understanding of Company-Specific Risks: Consultants may lack the nuanced awareness of a company’s unique operational risks and dynamics—information crucial for accurate forecasting.

- Dependence on Models and Assumptions: Relying solely on models created by consultants can lead to oversimplified forecasts that fail to address the complex realities of the construction landscape.

These limitations emphasize the importance of combining external insights with internal expertise for a more robust risk forecasting strategy.

Challenges in Risk Forecasting

Several inherent challenges further complicate the risk forecasting landscape:

- Uncertainty and External Factors: Market volatility, weather conditions, and unpredictable consumer behaviors introduce layers of uncertainty that are often beyond an organization’s control.

- Deep Uncertainty: The unpredictable nature of the future, filled with unknown variables, makes it unwise to depend solely on historical data or predictive models.

- Forecast Errors: Research indicates that advanced forecasting strategies, like stochastic models involving probability distributions, can minimize forecasting errors, yet these require an understanding of the company’s specific risks and assumptions.

These challenges highlight the necessity for a multidimensional approach to risk forecasting, emphasizing the integration of internal insights along with advanced analytical tools.

Best Practices and Emerging Innovations

To effectively navigate the complexities of risk forecasting, organizations should adopt practices that blend both internal insight and advanced technological solutions:

- Incorporate Internal and External Perspectives: Striking the right balance between internal knowledge and external expertise guarantees that risk management strategies are well-rounded and relevant.

- Use Advanced Solutions: Construction platforms like Zepth can offer continuous monitoring and powerful data analytics that streamline risk management processes. Such tools can integrate risk forecasting into strategic planning seamlessly.

- Sophisticated Risk Assessment Models: The adoption of advanced modeling frameworks, like stochastic models, can enhance accuracy by considering a broad spectrum of variables and potential outcomes.

By employing these techniques, organizations can not only improve risk forecasting but also enhance their overall adaptability and resilience against unforeseen disruptions.

Role of Zepth in Risk Forecasting

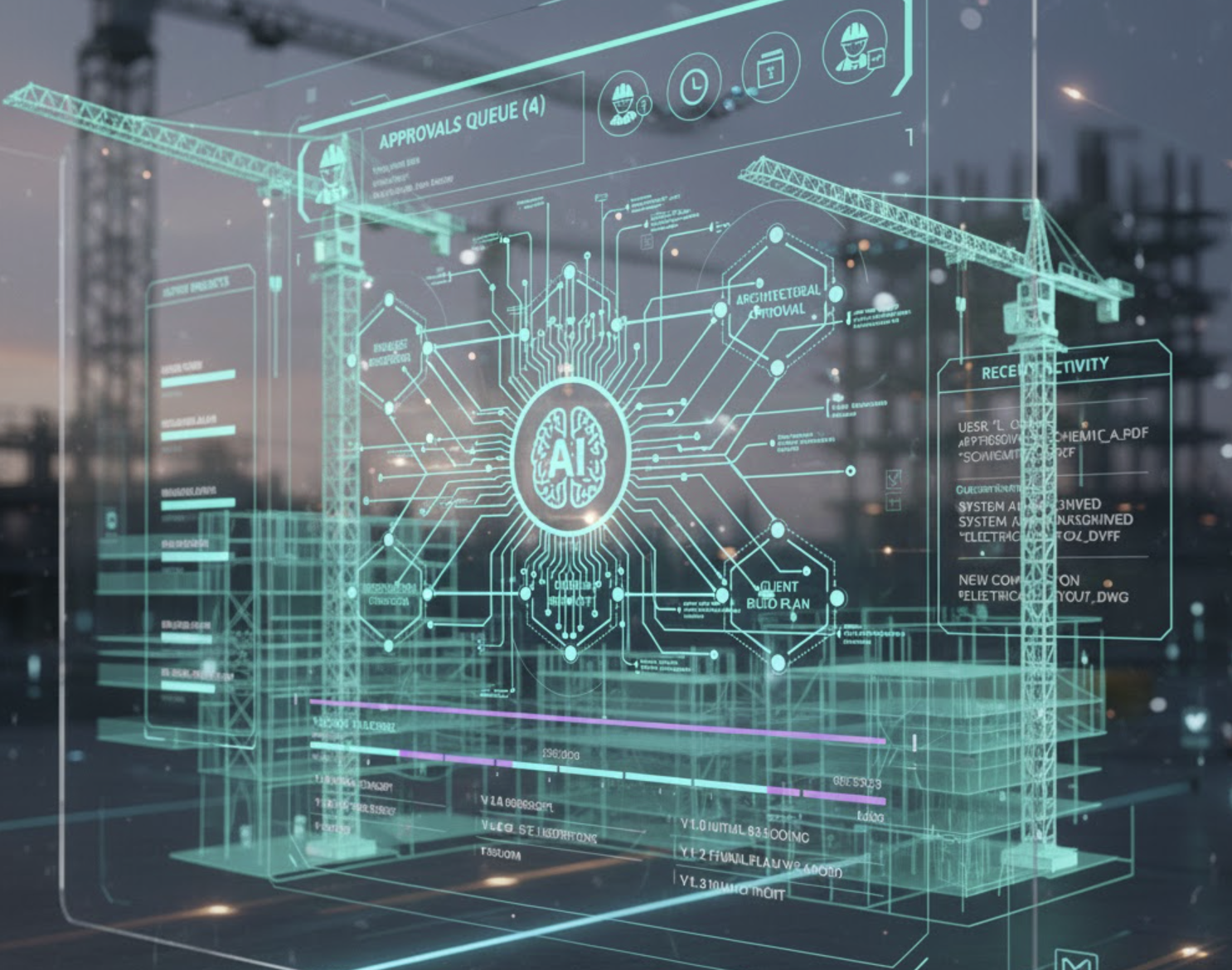

Amidst the challenges and best practices, Zepth emerges as a game-changer in the realm of risk forecasting:

- Continuous Monitoring: The Zepth platform facilitates the continuous monitoring of risks, ensuring that organizations remain vigilant and responsive to evolving threats and opportunities.

- Company-Specific Risk Understanding: Zepth’s integration capabilities with internal data systems allow organizations to develop a nuanced understanding of their risks, enabling tailored strategies for mitigation.

- Advanced Data Analysis: By leveraging Zepth’s tools for complex data analysis, organizations gain critical insights necessary for informed strategic decisions.

In summary, while consultants can add value to risk forecasting processes, relying solely on their expertise is insufficient. Organizations must embrace a comprehensive approach that combines internal capabilities with advanced technological solutions such as Zepth, ensuring effective risk management and robust strategic decision-making. This hybrid methodology not only safeguards against potential risks but also paves the way for long-lasting operational success.