Optimizing CapEx across U.S. portfolios has become a strategic imperative in the era of elevated construction costs, labor scarcity, regulatory pressure, and the unrelenting demand for asset performance. Hotel CAPEX control software and intelligent asset platforms have evolved from nice-to-haves into mission-critical systems for owners and operators navigating geographically and functionally diverse portfolios. Leading solutions like Zepth Edge transform disparate project data into a unified decision-making advantage—covering portfolio foresight, cost efficiency, and asset reliability—underpinned by AI-driven insights and robust financial controls.

U.S. Portfolio CapEx Optimization: The Strategic Context

Capital expenditures (CapEx) represent more than sunk costs—they define how portfolios evolve, adapt to market changes, and unlock sustainable competitive advantage. In multi-asset and multi-regional portfolios, CapEx optimization means making informed decisions on where to deploy scarce capital, how to phase and manage projects, and how to ensure every dollar invested drives maximum lifecycle value and risk reduction. Owners face compounding pressures: the Bureau of Labor Statistics notes double-digit material cost increases since 2020, skilled labor remains in short supply with deficits pegged at over 500,000 workers, and persistent inflation has driven up borrowing costs. Overlay this environment with intensifying ESG mandates and stricter local building codes, and the margin for misallocated CapEx or project overruns grows unacceptably slim.

One recurring question for asset managers is, ‘What are the best practices for hotel CapEx optimization?’ The answer centers on marrying data-driven prioritization with structured governance and end-to-end project controls—the foundation of which is a robust, cloud-based hotel financial management platform able to break down silos and enable continuous portfolio performance monitoring.

Core Pillars of CapEx Optimization Across U.S. Portfolios

Strategic Portfolio Planning and Prioritization

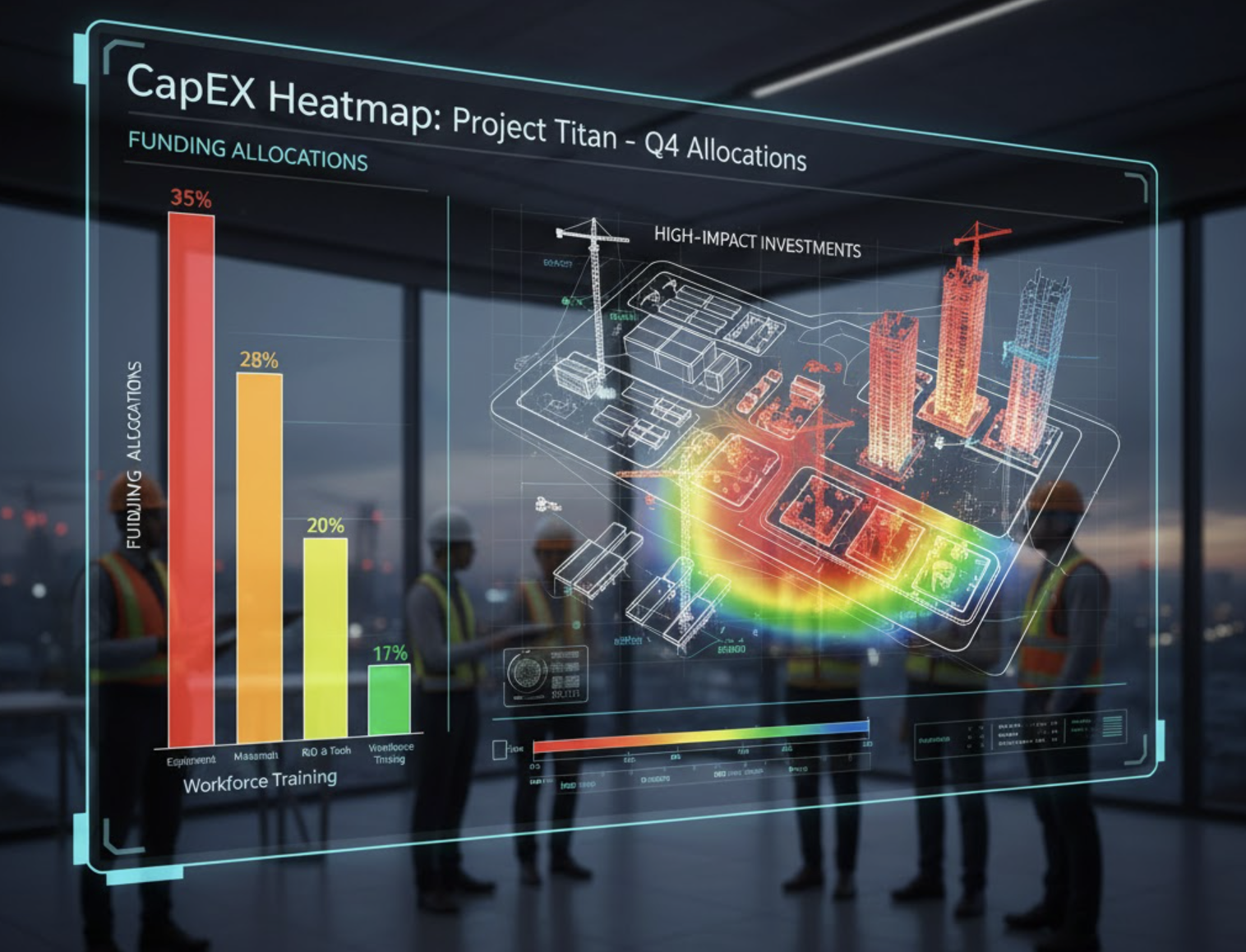

Transitioning from a project-by-project approach to holistic portfolio optimization is a game-changer for asset owners. It starts with consistently ranking CapEx candidates based on metrics like NPV, IRR, payback period, compliance risk, revenue uplift, and ESG impact. Data-driven facility condition assessments (FCAs) standardize the evaluation of system lifecycles, deferred maintenance backlogs, and compliance gaps. This then feeds Capital Needs Assessments, forming the bedrock of a 5- to 10-year investment roadmap. Scenario planning—modeling different interest rates, demand swings, and capital constraints—creates resilience in strategy.

Zepth Edge centralizes hotel asset management platforms, providing cross-property visibility into costs, schedules, risks, and strategic alignment. Standardization tools—project templates, cost codes, and centralized dashboards—help decision-makers compare like for like and create clear, actionable priorities at the portfolio level. This ensures steering committees and investment boards can dynamically allocate funds, respond to market changes, and avoid the duplication of efforts or data silos that drive up lifecycle costs.

Building Robust Business Cases and Capital Allocation Strategies

Effective CapEx optimization relies on the rigor of business case development. Standardized templates, incorporating strategic rationale, scope, phasing, lifecycle cost analysis, and ESG implications, ensure each project stands up to scrutiny. Discounted cash flow models compare multi-year projects, clarifying which initiatives deliver the most value per dollar invested.

Portfolio leaders categorize opportunities into ‘must-do’ (life safety, risk), ‘value preservation’ (asset life extension), ‘value creation’ (revenue growth), and ‘strategic/transformational’ (digitalization, decarbonization) buckets. Scorecards, harmonized through platforms like Zepth, allow fast, transparent capital allocation across markets and asset types. Equally essential: understanding CapEx versus OpEx trade-offs—such as when energy retrofits or automation investments can reduce future operating costs—and leveraging real-time insights from hotel OPEX management tools to refine ongoing strategies.

Zepth Edge’s centralized repository tracks all business cases, budgets vs. actuals, and approval workflows—creating the institutional memory needed to refine future decision-making and optimize future budget planning. Business leaders often ask, ‘How can technology improve hotel budgeting and forecasting accuracy?’ The answer lies in adopting an AI financial reporting platform that unifies financial data, tracks project changes in real time, and provides benchmarks for ongoing refinement.

Enterprise-Wide Cost Management and Standardization

Industry benchmarks—such as cost per square foot for commercial, per bed for healthcare, or per megawatt for data centers—form the baseline for cost validation across sites. A unified Cost Breakdown Structure (CBS) allows cross-project analytics, central procurement, and streamlined contract strategies, furthering the cause of hotel CAPEX optimization across regions. Early-phase value engineering ensures designs remain outcome-focused and avoid expensive overengineering or unnecessary scope.

- Centralized cost coding for all projects under one platform

- Unified workflows for budget, change orders, and payment approvals

- Historical project data for internal benchmarking and cost predictability

- Analytics to monitor budget variances and standardize cost control practices

Zepth Edge’s cost management modules enable this level of control, integrating change management, payment tracking, and performance benchmarking for every asset in the portfolio. This not only improves cost certainty but also ensures auditability and compliance with increasingly stringent financial reporting and governance requirements.

Advanced Project Controls and Risk Management

Integrated controls combining time, cost, and scope are vital. Earned Value Management (EVM) methodologies—measuring cost and schedule indices—allow early detection of overruns, inefficiencies, and opportunities for reallocation. Project dashboards and risk registers, centralized through Zepth Edge, provide structured oversight of uncertainties: from permitting delays by region and supply chain interruptions, to site-specific weather or labor constraints.

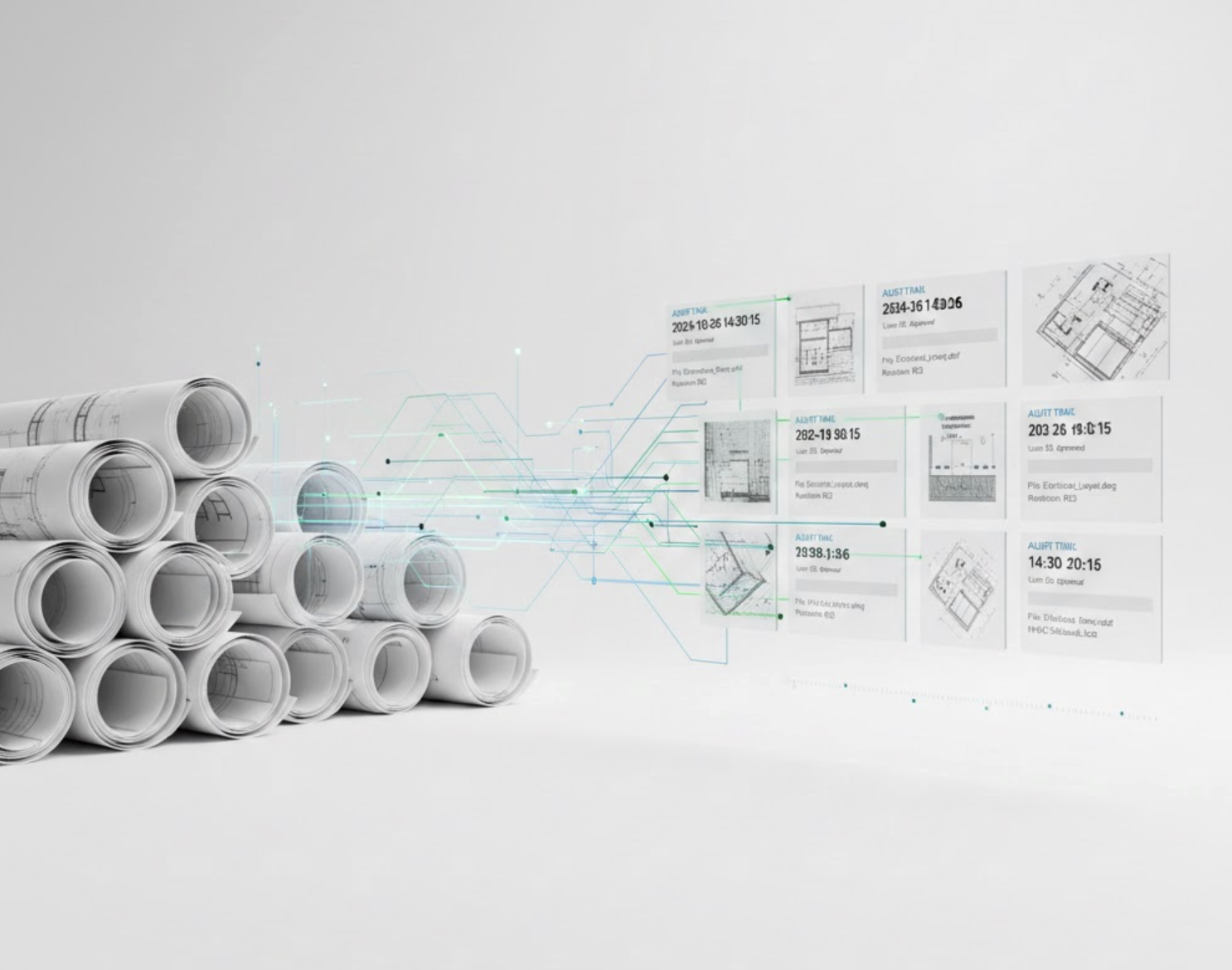

Transparent audit trails, change management logs, and disciplined processes mean stakeholders can easily analyze the root causes of budget or schedule variances. In practical terms, owners frequently wonder, ‘How does AI-driven construction management improve CapEx return on investment?’ By leveraging predictive analytics and centralized data feeds, AI tools for hotels and large real estate portfolios flag cost overrun risks, schedule threats, and performance issues before they escalate, ensuring smarter, faster intervention.

Digitalization, Data Infrastructure, and Cloud Ecosystems

Modern AI-powered hospitality management depends on breaking down information silos. Effective CapEx execution uses a single source of truth across contracts, schedules, cost reports, drawings, site data, and change orders. Portfolio dashboards offer real-time, actionable insight into capital burn rates, run-rate vs. plan, and forecast-at-completion.

Integration with ERP, BIM, scheduling, and IoT platforms ensures continuity between site-level execution and corporate finance—enabling end-to-end digital transformation in hospitality asset management. Zepth Edge operates as this data backbone, providing open APIs for interoperability and AI-enabled dashboards for smart hotel management tools. Decision-makers thus gain not only deep historical analytics but also predictive capabilities for future capital needs based on asset health and performance.

Governance Models for Portfolio-Level CapEx

Effective CapEx governance cascades from the C-suite, through program managers, down to project delivery teams. Corporate leaders set investment strategies and performance targets. Program managers coordinate related projects for consistency and economies of scale, while project teams deliver scope on cost, schedule, and quality.

Stage-gate workflows—with gates from opportunity identification through design, funding, build, and post-occupancy review—ensure funding only releases as each milestone is validated. Real-time KPIs, available via Zepth Edge dashboards, enable early intervention if projects deviate from plan. Advanced workflow automation and audit trails embed consistent, accountable decision-making, driving compliance regardless of asset geography or delivery model.

CapEx Optimization by Asset Type: Commercial, Industrial, Healthcare, and Data Centers

Optimizing CapEx is not one-size-fits-all; different asset classes present distinct investment drivers and operational challenges:

- Commercial real estate (office, retail, mixed-use): Focused on modernization, building system upgrades, and ESG retrofits. Zepth Edge’s program management helps bundle projects across U.S. cities, enabling volume pricing and phasing to minimize disruption.

- Industrial and logistics: Heavy investment in automation, warehouse expansion, and resilience. Centralized risk and schedule tracking by Zepth Edge is essential for distributed sites with limited oversight bandwidth.

- Healthcare and life sciences: Requires robust document control and compliance management, as regulated upgrades and expansions need flawless traceability across multi-campus portfolios.

- Data centers and mission-critical: Prioritizes schedule control, redundancy investment (N+1 systems), and security. Tight, integrated project controls via Zepth Edge reduce risks that would directly impact uptime and revenue.

Best Practices in U.S. Portfolio CapEx Optimization

Leaders in CapEx management employ a suite of best practices:

- Multi-year, integrated capital roadmaps that align business strategy, asset condition, and regulatory shifts

- Standardized processes for project delivery, documentation, and reporting across all assets

- Program-based delivery for economies of scale and unified governance

- Data-driven post-project reviews to feed accurate learnings into the next round of planning

- Integration of sustainability and resilience into all CapEx decisions using total cost of ownership metrics

- Shared KPIs between construction, finance, and asset teams

- Modern construction technology platforms (like Zepth) to eliminate Excel-based silos and unify project management, cost control, risk, and analytics

Zepth Edge underpins these best practices by offering templates, standardized workflows, program-based reporting, and AI analytics for continuous improvement. It supplies the AI hotel automation platform and cloud-based hospitality management system the market needs for the next generation of hospitality portfolio management.

Emerging Trends and Innovations Shaping CapEx Strategies

The future of CapEx optimization pivots on digital innovations. Machine learning algorithms, trained on historical data, predict cost overruns, flag high-risk contractors, and optimize contingency. Digital twins and BIM, paired with real-time data feeds, empower dynamic asset lifecycle management—pinpointing the optimal moment for maintenance or upgrade. Modular construction accelerates rollout across distributed assets with cost and schedule certainty. The rise of ESG-linked financing means projects that hit sustainability targets can unlock preferential terms, requiring transparent documentation and performance reporting—well suited to Zepth Edge’s secure, structured data capture.

Asset owners naturally ask, ‘What role does AI play in hospitality forecasting tools and portfolio management systems?’ The answer: AI closes the loop between real-world performance and forward-looking strategy, enabling true smart portfolio performance management and hotel lifecycle optimization.

Zepth Edge: The Intelligence Edge for CapEx Execution

Zepth Edge is the intelligence edge that U.S. portfolio managers need. It does not just connect financial, asset, and operational data—it transforms it into actionable insight. Owners and operators benefit from:

- 30% CAPEX efficiency via smarter, AI-driven forecasting and preemptive controls

- 10% revenue uplift from real-time analytics and occupancy management

- 50% higher asset uptime from integrated lifecycle and risk management

- Real-time portfolio oversight to surface trends, deviations, and improvement opportunities before they impact bottom line

Through modules for financial overview, occupancy tracking, guest segmentation, service quality, budget and CAPEX management, asset register, asset disposal, MIS reporting, and operations, Zepth Edge is the central nervous system for CapEx execution. Open APIs ensure it fits into existing digital ecosystems, extending value across the entire lifecycle from planning to replacement.

For hotel owners and U.S. real estate investors ready to move from fragmented processes to unified, data-driven portfolio management, Zepth Edge stands as the definitive platform—a next-generation solution at the intersection of AI, hospitality, and sustainable growth.