Financial standardization for regional portfolios is the foundation modern owners, developers, and operators rely on to ensure control, comparability, and smart capital deployment across their construction footprints. With teams running projects across diverse geographies—each with its local norms, tax environments, and reporting quirks—creating a consistent approach to cost control, budgeting, reporting, and decision-making has become critical not just for individual properties or projects, but for the health of the entire portfolio. For leaders seeking to leverage cloud-based hotel asset management platforms and hotel financial management software like Zepth Edge, aligning standards unlocks true portfolio-level insight and efficiency.

Why Financial Standardization Matters in Regional Construction and Hospitality Portfolios

Without standardization, financial data splinters into silos: spreadsheets and legacy ERPs in one region, ad-hoc templates in another, and disconnected contract and procurement systems elsewhere. This fragmentation makes it nearly impossible to obtain a real-time, apples-to-apples picture of committed costs, margin exposure, or risk—in short, it blocks true hotel portfolio management system capabilities. By deploying a unified framework across all regions, operators can track hotel CAPEX, control OPEX, and measure performance using the same yardsticks. This empowers capital planners and asset managers to reallocate investment swiftly, identify underperforming segments, and drive up returns across the board.

Questions often arise such as, “Why is financial standardization important for hotel and infrastructure portfolios?” The answer lies in clarity—standardization allows leaders to compare costs, risks, and returns across every geography and asset type, ensuring resource allocation is always data-driven. For stakeholders navigating currency volatility, regulatory quirks, and local process resistance, a unified approach, enabled by AI tools for hotels, brings clarity and order to complexity.

Core Elements of Financial Standardization for Regional Portfolios

Implementing financial standardization in the built world is a multi-faceted journey. The foundation rests on standardized cost breakdown structures and globally harmonized cost codes, drawn from frameworks such as CSI MasterFormat, UNIFORMAT II, and NRM/RICS. These universal hierarchies enable consistent project-to-project and region-to-region comparisons, opening the doors to true benchmarking, parametric estimating, and portfolio analytics.

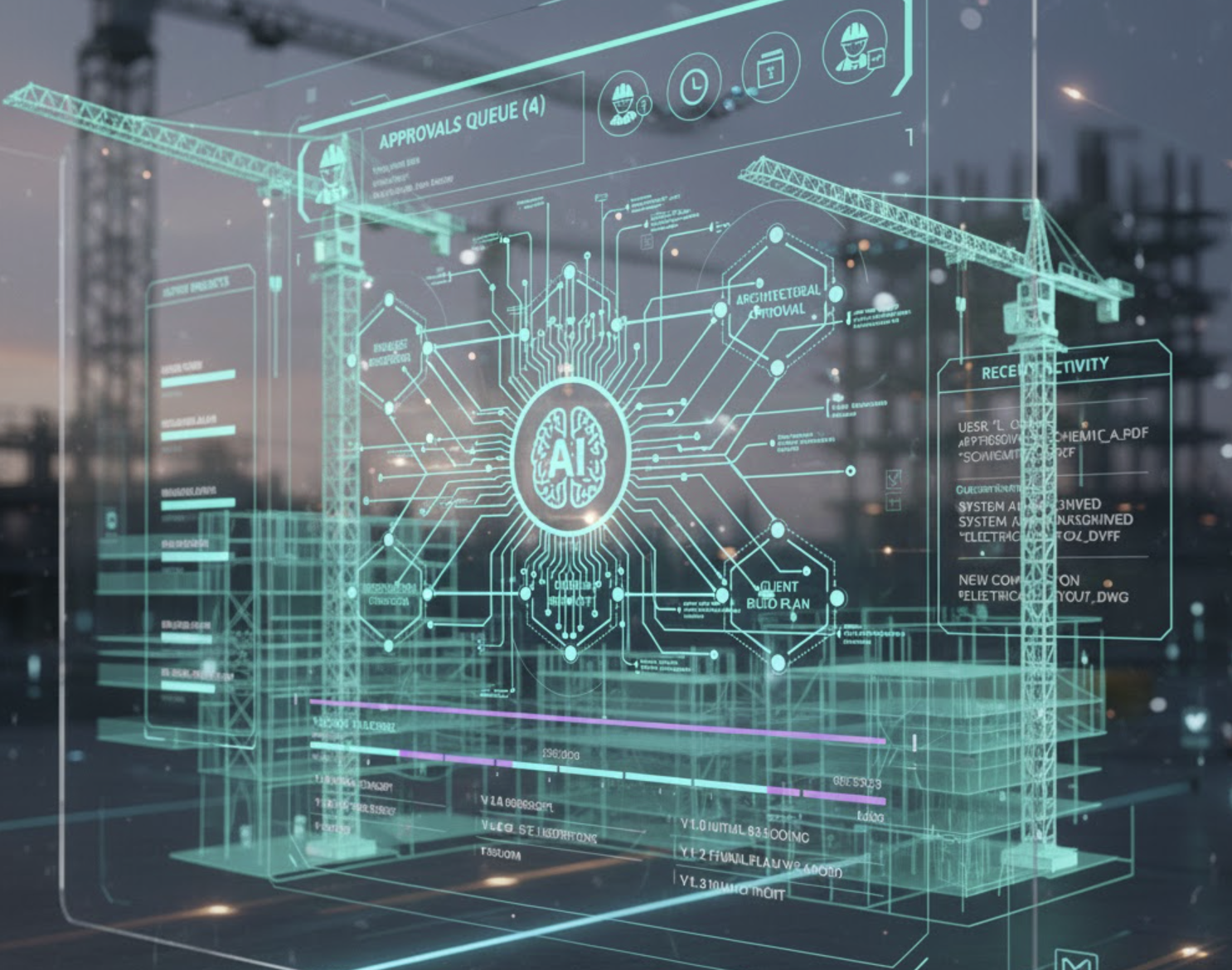

Zepth Edge’s hotel asset management platform enforces these frameworks across all projects. Its intelligent architecture supports:

- Central cost breakdowns and hierarchical, region-mappable cost codes

- Unified budgeting and forecasting workflows with real-time tracking

- Standard dashboards that display actuals, variance, and forecasting at every level

- Configurable KPIs: cost variance (CV), cost per unit, contingency as a percentage of original budget, and more

- Multi-currency and FX handling with monthly/quarterly programmable rates

For those wondering, “How does multi-currency and currency fluctuation impact financial reporting for international hotel portfolios?” the answer: robust platforms like Zepth Edge handle local currency inputs with seamless conversion to a portfolio reporting currency, applying central bank rates for true comparison, and separating pure cost growth from FX and inflation effects for clarity in analysis.

Key Drivers and Challenges in Achieving Standardization

Global construction and hospitality players are experiencing strong external drivers for standardization—ranging from regulatory pressure (IFRS, local GAAP, ESG mandates) and industry watchdogs, to the relentless need for capital discipline as showcased by consistently high rates of cost overruns and project delays. On the flip side, they face persistent challenges: local accounting rules, tax treatments, variable cost code schemas, inflation, and natural cultural and process inertia. Data, too, remains trapped in local ERPs, spreadsheets, and unintegrated tools, which blocks holistic performance management.

This is where Zepth Edge stands out as an AI-powered hospitality management solution; it sits above local tools, integrating with them while enforcing portfolio-wide standards. As a true cloud-based hospitality management system, it does not demand an abrupt switch from local practices but provides the mapping layers and workflow governance needed to bring fragmented data into one connected platform. The intelligent use of AI in hospitality and advanced analytics ensures that all data, regardless of origin, is harmonized for portfolio decision-making—unlocking smart hotel management tools across regions.

How Zepth Edge Enables Standardized Financial Control for Regional Portfolios

Zepth Edge’s vertical-specific modules are engineered to standardize financial governance across every stage of the asset lifecycle:

1. Unified Financial Overviews and Budget Management

With the hotel financial tracking software in Zepth Edge, owners gain real-time visibility into revenue, expense, and profit metrics across all assets. The platform enables centralized CAPEX control with consistent CAPEX tracking in hospitality, and digitizes budgeting and forecasting workflows to provide a single source of truth for all financial operations. Thanks to robust OPEX management tools, OPEX and CAPEX budgets are governed with structured workflow approvals ensuring fiscal discipline, transparency, and compliance—key for maintaining hotel compliance and audit software standards.

2. Standardized Reporting, KPIs, and Analytics

MIS reporting within Zepth Edge generates standard dashboards and configurable templates for every region. Key indicators—cost performance index (CPI), risk-adjusted costs, cash flows, and claims frequency—are embedded across the platform. This enables reliable hotel revenue management analytics from the region, project, or portfolio level—essential for data-driven hospitality management and strategic capital allocation.

3. Multi-Currency, FX, and Inflation Management

All costs are tracked in both local currency and a central reporting currency. The system uses programmable FX update rules and regional escalation factors so that underlying performance is revealed—unclouded by currency volatility or inflation. Questioning “What are the best practices for managing CAPEX and OPEX across global hotel portfolios?” leads to the answer: standardize workflows, use digital platforms for approvals and audit-trails, and leverage AI hotel automation platforms such as Zepth Edge for scenario-based forecasting and risk management.

4. Powerful Asset and Operations Oversight

Zepth Edge’s asset register and asset disposal modules serve as a single source for asset lifecycle management for hotels—from acquisition to end of life. The operations and service management tools ensure quality standards and compliance are maintained everywhere, aligning with portfolio-wide best practices and enabling lifecycle optimization for every property.

5. Integrated Risk and Contingency Management

Risk management tools connect risk registers directly to financial dashboards, aligning the identification, scoring, and mitigation of threats with project and portfolio budget tracking. This AI-driven performance dashboard ensures risk cannot be overlooked or siloed; it is quantified and controlled at every level—a critical ability for any next-generation hospitality platform.

Success Stories: Financial Standardization in Action

Consider a global developer running commercial and infrastructure assets in the US, Middle East, and APAC. By using Zepth Edge as their standard portfolio dashboard, they gain immediate insight into regional performance, can benchmark projects using standardized metrics, and reallocate resources swiftly based on real-time data. For infrastructure funds managing PPP/concession projects, Zepth’s integrated CAPEX/risk model delivers transparent scenario analysis and structured, auditable data for investors. Multinational contractors with regionally autonomous business units harness Zepth to harmonize internal cost codes, claims management, and risk controls, all tracked through universal KPIs and audit-ready workflows.

Best Practices for Implementing Financial Standardization

To build effective standardization, begin with transparency, comparability, and risk-informed decision-making. Define global cores—cost structures, reporting templates, and KPIs—and permit region-specific extensions. Integrate standardization layers through systems like Zepth rather than replacing local ERPs overnight, using mapping to align data above the region. Rolling out gradually—region by region—allows the center of excellence to refine templates and governance, while training and helpdesk support ensure smooth adoption. Once in place, standardized data powers true analytics and benchmarking: cost models by geography, parametric estimates, automated lesson-capture from overruns, and more.

Emerging Innovations: AI, ESG, and the Digital Transformation of Portfolio Management

Financial standardization is now the launchpad for digital transformation in hospitality and construction. AI-driven hotel management uses historical standardized data to predict cost overruns, flag high-risk projects, and run what-if scenario planning on FX movements or supply chain disruptions. Integrated project controls now fuse risk, cost, schedule, and scope in a unified, cloud-native-controls framework—enabling smarter, risk-adjusted portfolio decisions. With ESG and sustainability metrics increasingly required by asset owners and funds, platforms like Zepth Edge include ESG-linked cost codes and performance indicators in every workflow, blending financial and green reporting into a single dashboard. And as cloud-based hospitality management systems with open APIs become the norm, organizations benefit from a central data lake, secure auditability, and scalable integrations that futureproof their financial control infrastructure.

Why Zepth Edge Should Be Your Standardization Platform

Zepth Edge stands apart as an AI asset management software and smart portfolio performance management solution, uniquely tuned for the challenges of regional construction, infrastructure, and hospitality portfolios. It delivers:

- Unified portfolio views and real-time analytics across regions

- Centralized cost, budget, and risk control workflows

- Comprehensive governance and compliance tools with version histories

- Multi-currency capabilities and seamless integration with local financial systems

- The foundation for next-generation hospitality platforms built on data-driven insight, AI-enabled automation, and ESG accountability

As the built environment grows more complex and capital flows become global, only the organizations who can see, compare, and act across regions will win. Financial standardization—with Zepth Edge at its center—is the lever for control, insight, and performance across every asset in your portfolio.