Dubai’s rapid transformation into a global hub for real estate and hospitality investments hinges on robust portfolio control. For owners, developers, and investors, success means consistently aligning capital, compliance, and quality across diverse project portfolios. Whether overseeing luxury hotels, residential towers, or infrastructure, leveraging advanced hotel management software and portfolio management systems is now essential. In this article, we dive deep into why portfolio control matters in Dubai, common challenges, and how next-generation tools like Zepth Edge enable data-driven command in the region’s unique market environment.

Understanding Dubai’s Portfolio Control Imperative

Dubai’s construction and real estate sector continues to expand, with a market valuation hovering around USD 100 billion in 2023 and growth projected well into 2028. Megaprojects like Dubai Creek Harbour, Metro expansions, and green urban initiatives cement its status as a capital project epicenter. But with this scale comes volatility—fluctuating demand cycles, regulatory shifts, and sky-high investor expectations. Owners must not only oversee completion of individual projects but also ensure all activities align with broader strategic, financial, and operational goals. Here lies the distinction between project control (efficient delivery at the individual level) and portfolio control (balancing risk, capital, and opportunity across multiple projects and asset types).

For example, a property developer may simultaneously manage hospitality, residential, and logistics assets—each with specific stakeholder concerns and compliance needs. The stakes are even higher for hotels, where real-time operational data and AI hotel automation platforms can create a decisive competitive edge. As a foundational question: What is portfolio management in real estate? Simply put, it’s the strategic process of selecting, prioritizing, and steering projects in unison with company objectives, resource constraints, and market changes—vital for thriving in Dubai’s dynamic environment.

Strategic, Financial, and Operational Control: The Pillars of Portfolio Success

Sustaining predictable performance across Dubai’s competitive landscape demands portfolio control at several levels:

- Strategic Control: Align each project with long-term trends—such as tourism, sustainability, or affordable housing. Re-prioritize projects as market or policy direction evolves, and prevent asset-type concentration risk.

- Financial Control: Set top-down investment envelopes, control budgets, track cumulative cost performance, and avoid liquidity crunches by leveraging consolidated hotel financial tracking software for all projects.

- Operational Control: Standardize processes for RFIs, quality, and safety inspections, and gain a cross-portfolio view of schedules and bottleneck resources.

Platforms such as Zepth Edge are revolutionizing these domains. By providing cloud-based dashboards, real-time budget burn rates, AI-driven cost and schedule risk identification, and configurable workflows, Zepth enables decisive action. By aggregating all project and asset intelligence into a single connected ecosystem, it underpins not only financial rigor but also portfolio foresight and resilience.

What is the difference between project control and portfolio control? Project control focuses on ensuring each initiative hits its time, budget, and quality requirements. In contrast, portfolio control is about managing the collection of projects holistically—balancing roles, funding, and strategy for the entire group, especially important in volatile markets like Dubai.

Navigating Dubai’s Regulatory, Governance, and Compliance Landscape

Dubai’s ambitious construction market operates under the tight scrutiny of multiple authorities, such as the Dubai Land Department (DLD), RERA, municipality, and energy agencies. Each demands rigorous compliance: property registrations, escrow management for off-plan sales, safety certifications, and fast-evolving green building standards under Dubai’s Net Zero 2050 and Clean Energy Strategy. Owners must track and synchronize regulatory processes across all jurisdictions, as delays or non-compliance on even a few projects can seriously impact overall portfolio performance and investor confidence.

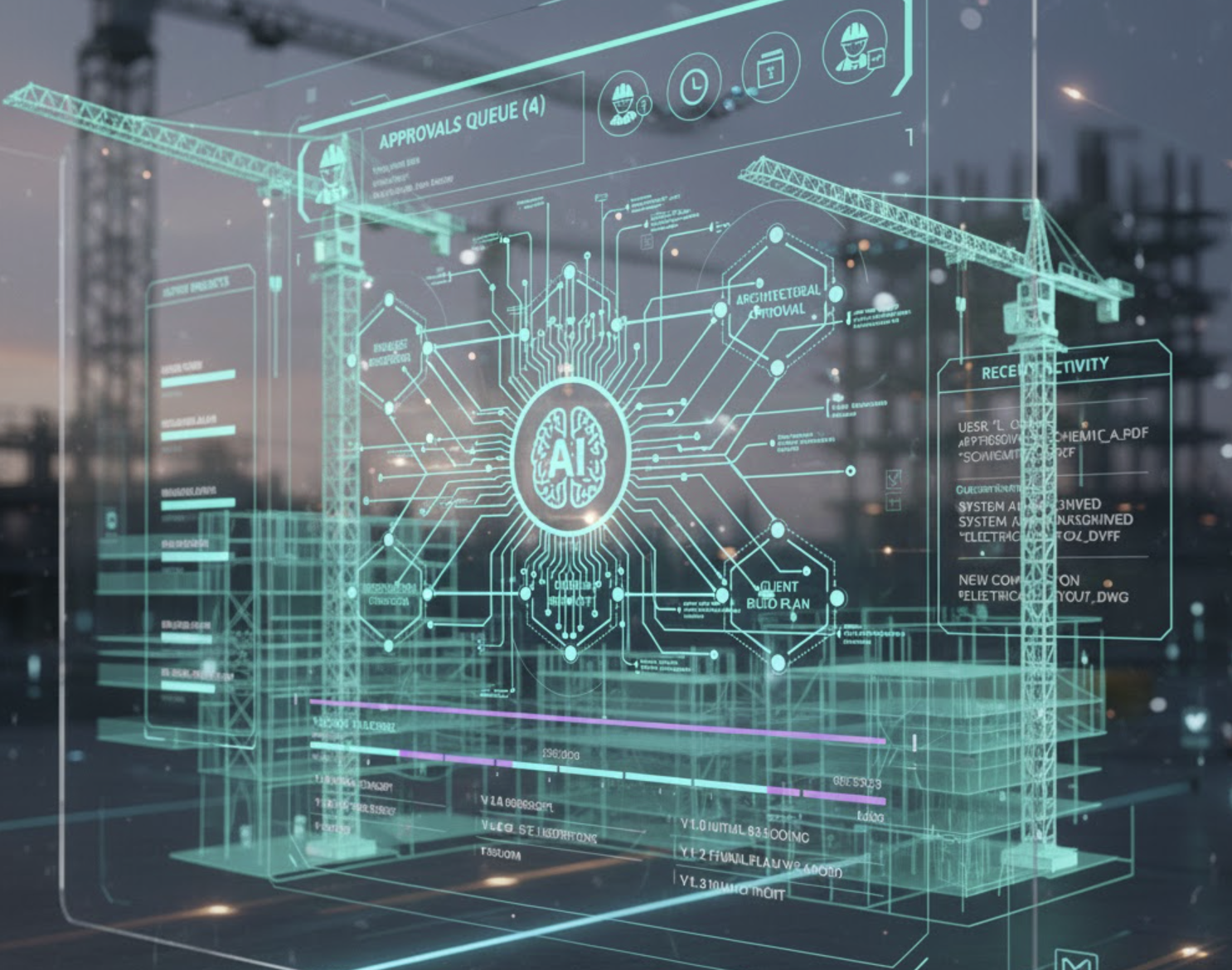

The governance structures required for this environment are robust—spanning portfolio committees, central PMOs, and formal stage-gate documentation. Equally, data transparency for risk management is paramount. Are you wondering, How can software improve compliance in real estate and construction? A powerful hotel asset management platform like Zepth simplifies this burden by digitally managing submissions, approvals, and compliance documents. Workflows can be configured to mirror Dubai-specific stages, while AI analytics deliver real-time risk heat maps for board, lender, and regulatory reporting—all adding up to fast, auditable responses in a complex environment.

Digital Transformation: The Secret to Smart, Scalable Portfolio Management

Digitalization is at the heart of Dubai’s real estate and hospitality evolution. Key initiatives include BIM integration for design coordination, common data environments (CDEs) for cross-stakeholder collaboration, drones and IoT-enabled site monitoring, and advanced ESG reporting. Despite these advances, many organizations remain hampered by siloed software and inconsistent reporting standards. This is where next-generation, AI-powered hospitality management systems are transforming the market:

- Centralized Dashboards: Real-time visibility into cost, schedule, risk, ESG, and operational KPIs across all assets.

- Standardized Workflows: Uniform templates and processes ensure data comparability and cut inconsistencies in reporting.

- Predictive Analytics: Automated alerts and scenario models flag emerging risks, cost overruns, and resource bottlenecks before they escalate.

Zepth Edge leads this digital transformation. As a cloud-based hospitality management system with integrated AI hotel automation platform functionality, it provides a seamless interface for owners, investors, and operators to act on actionable insights. Its hospitality analytics and insights modules surface trends in occupancy, guest satisfaction, CAPEX spend, and regulatory status—advancing data-driven decision-making at every level.

Practical Strategies for Maintaining Portfolio Control in Dubai

How can organizations systematically drive portfolio efficiency, compliance, and resilience in such a uniquely dynamic market? A few actionable steps can make all the difference:

1. Establish a Portfolio Management Framework: Define objectives—financial returns, geographic diversity, and sustainability mandates. Use clear project selection criteria and standardized KPIs. Zepth Edge tracks these metrics and stage-gates, providing a secure system of record for governance compliance.

2. Standardize Data & Reporting: Implement common data codes, templates, and progress reporting tools across projects. Zepth’s flexible reporting modules unify data input, reducing errors and streamlining consolidation across portfolios.

3. Integrate BIM, Field Data, & ESG: Merge BIM models and field observations into the decision process—improving forecast accuracy and risk identification. Zepth integrates with external BIM and field tools, providing trend analysis at the contractor and asset-type level. This not only helps with project delivery but also supports sustainable hotel management practices and real-time ESG data capture.

4. Manage Contractor & Supply Chain Risk at Portfolio Level: Track and benchmark contractor performance, on-time delivery, safety incidents, and claims. Use the data to refine future procurement and limit single-source dependencies. Zepth stores supplier performance data, providing an evidence base for awards and negotiations.

5. Conduct Scenario Planning Regularly: Simulate shocks—policy changes, demand drops, or cost surges—and strategize which projects to accelerate or pause. Consolidated, real-time data from Zepth supports robust scenario modeling for executive teams and investment committees.

Stakeholder Use Cases: Real Value for Developers, Investors, and Public Sector Owners

A cross-section of Dubai’s real estate landscape reveals distinct priorities but a shared need for actionable, cross-portfolio intelligence:

- Developers: Manage design variants and off-plan contracts while balancing rapid completion with high quality and compliance. Integrate sales, construction, and finance data to ensure delivery on investor promises.

- Institutional Investors & Funds: Demand transparent dashboards summarizing financial performance, risk exposure, and ESG indicators to satisfy demanding governance requirements and attract capital.

- Government & Semi-Government Entities: Oversee diverse PPP and infrastructure programs in alignment with city-wide digital transformation and sustainability mandates—requiring standardized documentation and audit trails.

In each scenario, Zepth Edge delivers configurable reporting, centralized documentation, and multi-stakeholder engagement within one secure, scalable environment.

Innovations Shaping the Future of Portfolio Control in Dubai

The next wave of digital innovation will be crucial for maintaining competitive advantage, especially in a region where sustainability and lifecycle value are becoming investor imperatives. Emerging solutions include:

- Portfolio-Scale Digital Twins: Aggregating energy, occupancy, maintenance, and cost data to enable holistic asset optimization and informed development decisions across a diversified portfolio.

- Automated ESG Analytics: AI-led capture of embodied carbon, utility consumption, waste, and water metrics—ensuring compliance with international reporting frameworks and bolstering reputation among global investors.

- Integrated Construction-to-Operations Data Flow: Seamlessly transitioning construction data (warranties, assets, systems) to operations and asset management platforms for total lifecycle control.

Tools like Zepth act as the foundational AI asset management software layer, standardizing and feeding construction data into operational systems and digital twins, making advanced lifecycle and ESG analytics more accurate and cost effective.

This brings us to a relevant inquiry: How does AI help improve asset management in hospitality and real estate? AI-powered systems automate asset lifecycle tracking, flag maintenance before failures, spotlight resource inefficiencies, and identify opportunities for sustainable upgrades—directly improving uptime, compliance, and guest satisfaction across hotel portfolios.

Best Practices Checklist: Maintaining Portfolio Control in Dubai

To close, here are tried-and-true habits for strong portfolio command in the Dubai construction and hospitality industry:

- Set clear portfolio objectives and risk guidelines.

- Implement a central PMO or Portfolio Office to standardize procedures and own data.

- Utilize a cloud-based hospitality management system for unified records (cost, schedule, compliance, ESG).

- Standardize templates, approval workflows, and taxonomies for data comparability.

- Continually monitor contractor and supplier performance, integrating lessons learned into future procurements.

- Track authority and regulatory approvals digitally and in real time.

- Embed scenario planning and regular stress testing into board-level routines.

- Pursue lifecycle and ESG value—not just initial CAPEX or OPEX minimization.

- Adopt AI analytics to surface predictive insights and drive data-driven execution at every step.

Dubai’s competitive edge lies in intelligence—leveraging smart, integrated hotel portfolio management systems like Zepth Edge to unify, automate, and optimize every stage of the portfolio lifecycle, from capital planning to asset disposal. As market volatility persists and stakeholder demands evolve, digital transformation rooted in real-time analytics and AI-led operational intelligence will distinguish the leaders in construction and hospitality portfolio management.